capital gains tax changes 2021 uk

Capital Gains Tax changes that Self Assessment customers need to know. Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10.

How Biden S Build Back Better Hits Blue States Harder

Budget 2021 - Overview of Changes Administration and Compliance Changes Capital Gains Tax CGT.

2.png)

. Asset sales have increased by around 2 to 115 of the tax revenue over the last 12 months largely because of the nervousness that the. For 2021-22 youll be charged at 10 on the first 1m of gains when selling a qualifying business the same as the 2020-21 tax year. 2 For the tax year 2022-23 the savings rates of income tax are as follows a the savings basic rate is 20 b the savings higher rate is 40 and c the savings additional rate is 45.

Each year at the moment there is a personal capital gains tax allowance. A recent report from the UK Office of Tax Simplification OTS following a review of the Capital Gains Tax CGT has outlined some recommended changes to Capital Gains Tax. There was the Budget announcement delivered on 3 March together with the Finance Bill 2021 published on 11 March setting out medium-term tax and spending plans as the UK economy emerges from the COVID-19 coronavirus.

Basic rate taxpayers would face an increase of 10 to 20 capital gains tax or higher rates on large gains treated as. The CGT annual exempt amount therefore remains frozen at. Spring 2021 brought two key developments to the UK tax landscape.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. HMRC customers have until 31 January 2021 to declare any profit made from selling a UK residential property which was not. 2 days agoTax Foundation Capital Cost Recovery 2021 Capital Allowances 2021.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. The deadlines for paying Capital Gains Tax after selling a residential property in the UK are changing from 6 April 2020 - understand the changes and what you need to do. It is now considered that the changes which could potentially include more than doubling the top rate from 20 to 45 and taxing accrued profits of owner-managed companies at income tax rates could well be announced during the.

3 1 For the tax year 2022-23 the default rates of income tax are as follows a the default basic rate is 20 b the default higher rate is 40 and c the default additional rate is 45. Despite record levels of MA activity in the build-up to the Budget with Azets advising on 50 deals in just ten weeks no announcement was made and. Capital Gains Tax UK changes are coming.

Changes to UK CGT are likely to be an attractive option to the Chancellor as he looks at ways. Budget 2021 - Overview of Changes Administration and Compliance Changes Capital Gains Tax CGT. The biggest question asked of private client advisors over the past couple of years is when do we expect Capital Gains Tax CGT to increase.

It comes amid ongoing silence from the Treasury around rumoured changes to Capital Gains Tax CGT which had been expected to feature in the Chancellors Spring Budget 2021 on 3 rd March. Entrepreneurs relief was slashed last April so that instead of being charged 10 on the first 10m of gains anything above 1m would be taxed at the usual 20. Capital Gains Tax Spring Budget 2022.

If you own a property with a partner you both get that personal capital gains tax allowance. Costings are indicative HMRC estimates not certified by the. The necessary legislation will be introduced in Finance Bill 202122 and will also clarify that for UK residents where the gain relates to mixed-use property only the residential property portion of the gains has to be returned and paid.

Its the gain you make thats taxed not the. 275 27 33 4. Figures from the Treasury released in August show that its Capital Gains Tax receipts hit 98billion in the 201920 tax year up four.

In other words the first 24600 of profit you can get tax-free. The second part of the report is due in 2021. From 6 April 2020 if you.

UK Tax Quarterly Update May 2021. If the Chancellor equalised capital gains tax with the rates of income tax this would push the top rate of capital gains tax to 45 the income tax rate for additional rate taxpayers a rise of 25 for a higher and additional rate taxpayers. Once again no change to CGT rates was announced which actually came as no surprise.

Following a simplification review Capital Gains Tax CGT is an area that we have been expecting to hear some major announcements in but the Chancellor decided to leave things as they are with no changes being announced in the Spring Budget. So for the first 12300 of capital gain you could take that money completely tax-free. The capital gains tax-free allowance for the 2021-22 tax year is 12300 the same as it was in 2020-21.

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Why Capital Gains Tax Reform Should Be Top Of Rishi Sunak S List Autumn Budget 2021 The Guardian

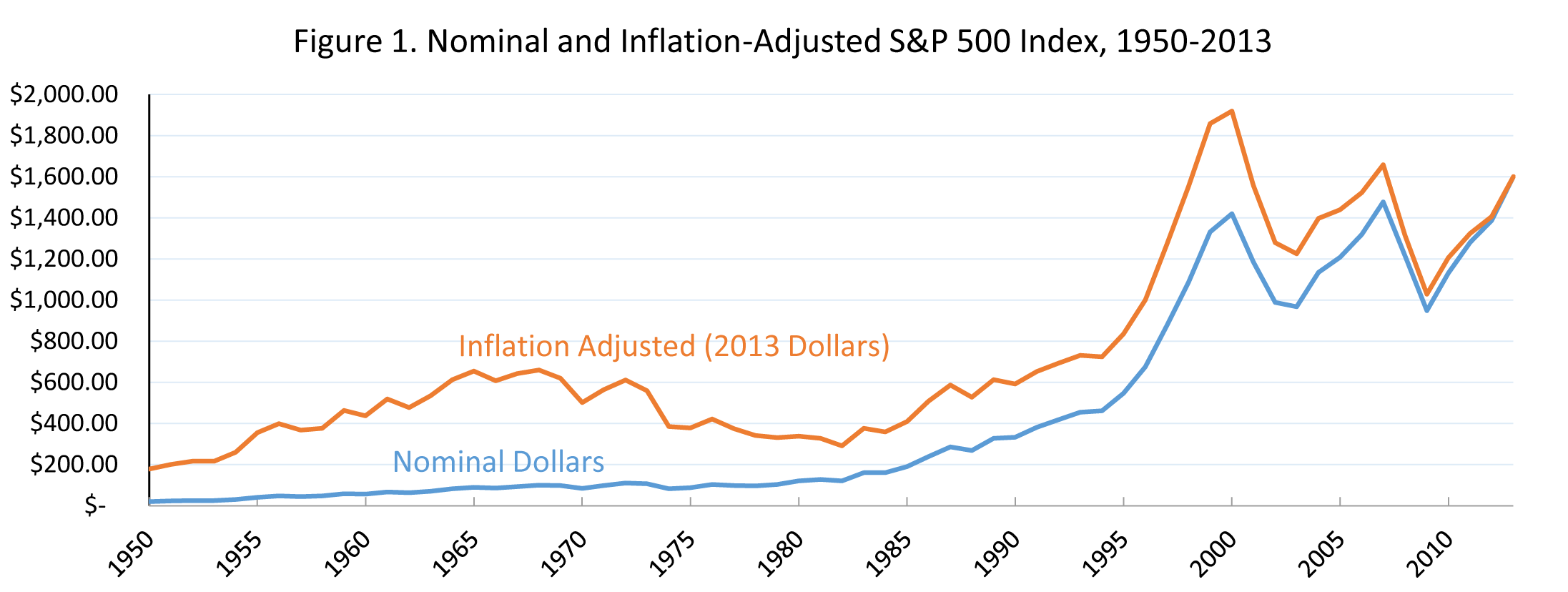

Inflation Can Cause An Infinite Effective Tax Rate On Capital Gains Tax Foundation

Selling Stock How Capital Gains Are Taxed The Motley Fool

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Can Capital Gains Push Me Into A Higher Tax Bracket

Difference Between Income Tax And Capital Gains Tax Difference Between

Budget Summary 2021 Key Points You Need To Know Budgeting Income Support Business Infographic

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

How Much Is Capital Gains Tax Times Money Mentor

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)